Renters Insurance in and around Central City

Welcome, home & apartment renters of Central City!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All Central City Renters!

It may feel like a lot to think through work, family events, keeping up with friends, as well as deductibles and providers for renters insurance. State Farm offers hassle-free assistance and unbelievable coverage for your tools, furnishings and electronics in your rented condo. When the unexpected happens, State Farm can help.

Welcome, home & apartment renters of Central City!

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

Renters often raise the question: Could renters insurance help you? Just pause to consider what it would cost to replace your valuables, or even just a few high-cost things. With a State Farm renters policy backing you up, you won't be slowed down by unexpected mishaps. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've stored in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Amber Griggs can help you add identity theft coverage with monitoring alerts and providing support.

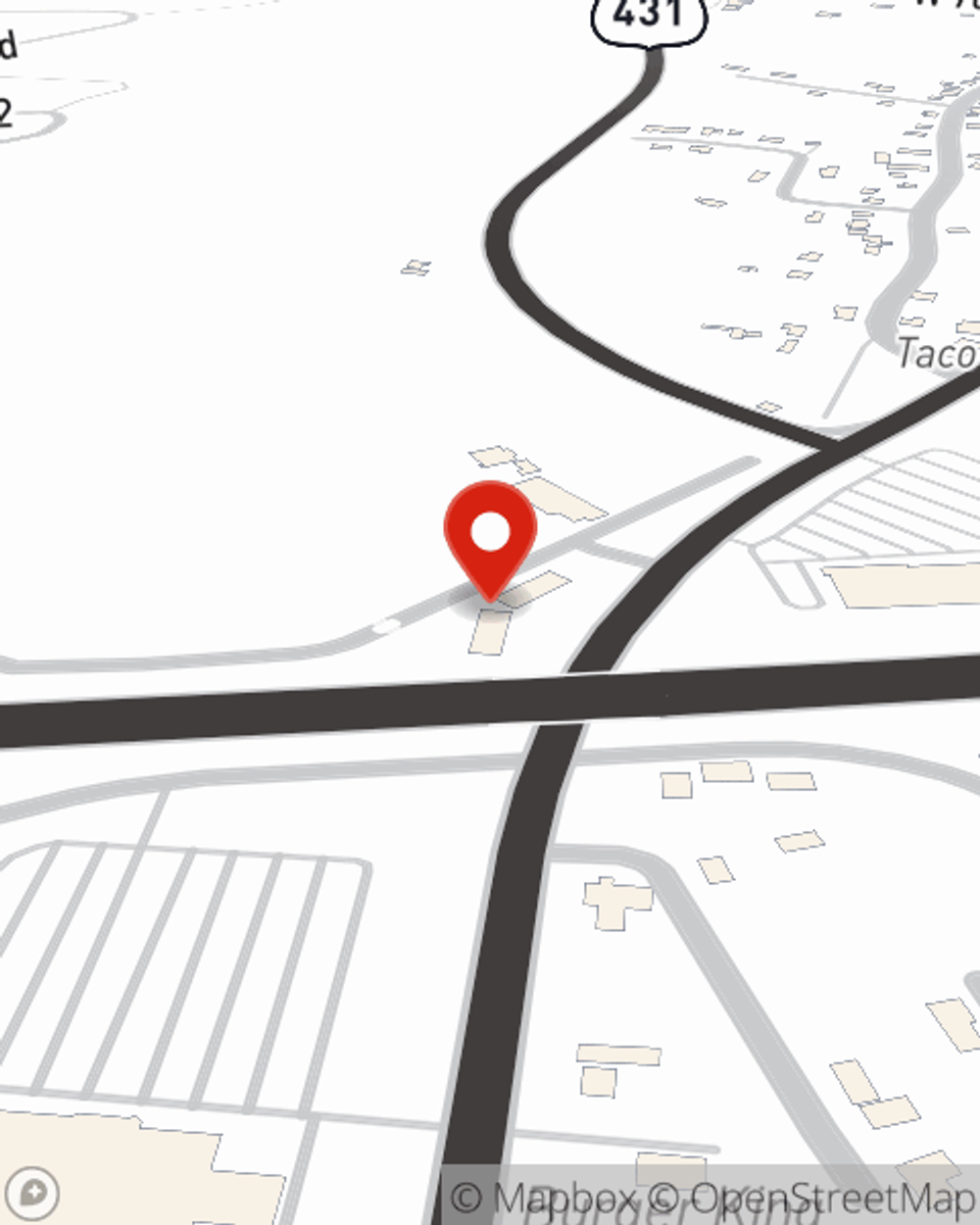

If you're looking for a committed provider that can help with all your renters insurance needs, get in touch with State Farm agent Amber Griggs today.

Have More Questions About Renters Insurance?

Call Amber at (270) 754-5165 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Amber Griggs

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.